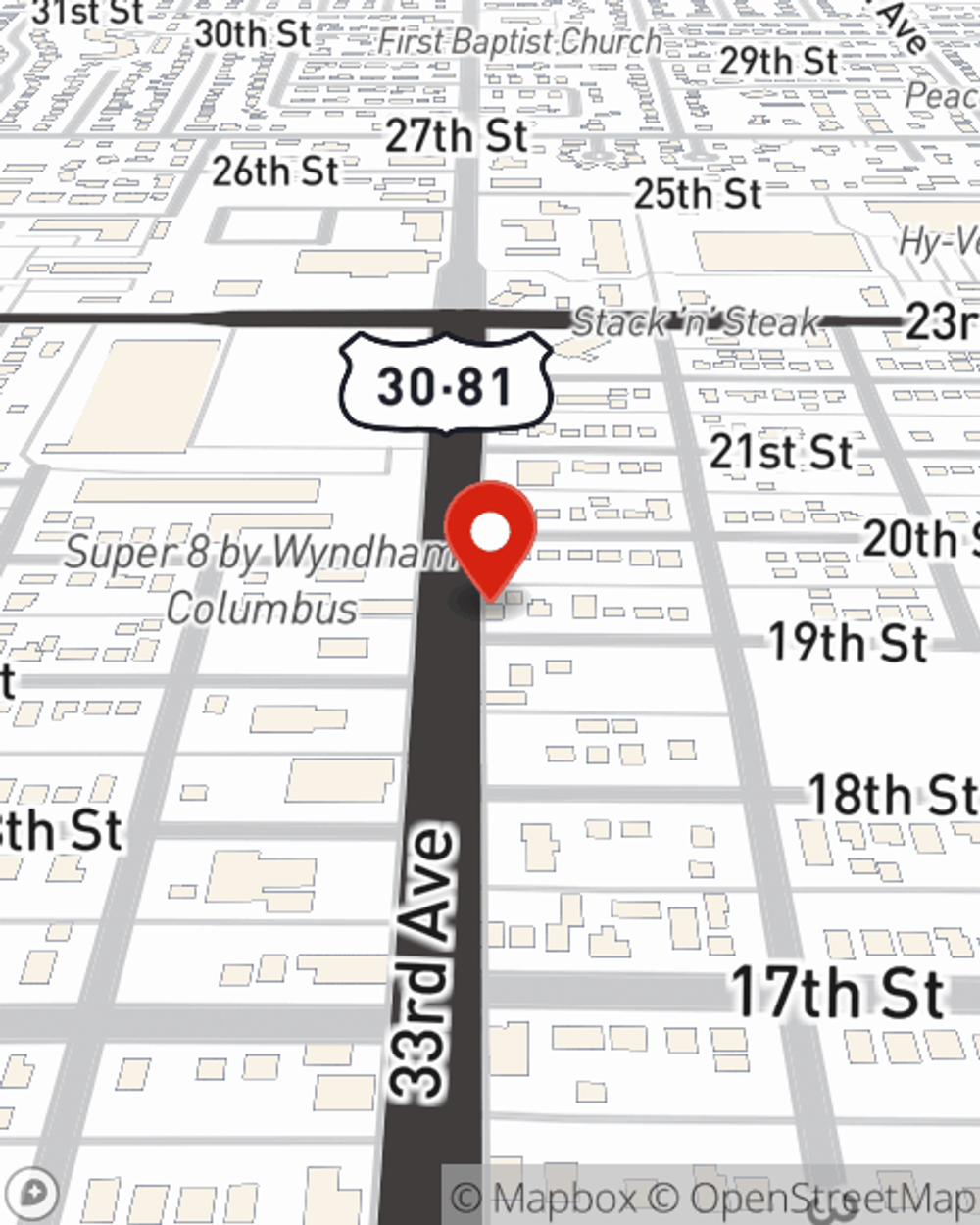

Life Insurance in and around Columbus

Get insured for what matters to you

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

Be There For Your Loved Ones

No one likes to fixate on death. But taking the time now to secure a life insurance policy with State Farm is a way to express love to your partner if death comes.

Get insured for what matters to you

Life won't wait. Neither should you.

Agent Annette Alt, At Your Service

The beneficiary designated in your Life insurance policy can help cover current and future needs for your partner when you pass away. The death benefit can help with things such as house payments, ongoing expenses or home repair costs. With State Farm, you can rely on us to be there when it's needed most, while also providing understanding, reliable service.

If you're looking for dependable insurance and compassionate service, you're in the right place. Call or email State Farm agent Annette Alt now to find out which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Annette at (402) 564-8581 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Annette Alt

State Farm® Insurance AgentSimple Insights®

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.